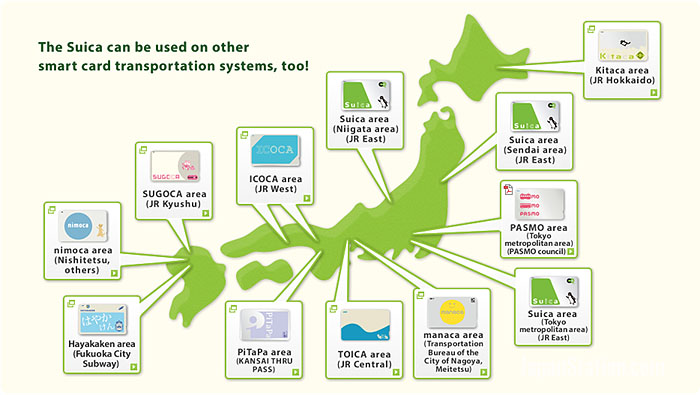

When you arrive in Tokyo, you’ll likely want to get a Suica card. Other regions of Japan have different cards based on what primary railways operate there. You can usually tell where a Japanese person is from based on the IC card they own.

I love my Suica (IC) Card! Personally, I hate handling cash. Who knows how many hundreds of people have touched it and if they’re sick (whoops, getting a little OCD there). IC cards basically work like a prepaid credit card. The original intent is for it to be used on the rail lines (trains) within Japan. These days you can also use it at many businesses, coin lockers, busses, parking lots, and much more.

For instance, I can go to a kombini (convenience store) and pick anything I want off the shelves and just scan my Suica card and walk out. Money is automatically deducted from my prepaid account.

Many people fumble with the ticketing systems within Japan to travel on the subways or railways. Even the locals have difficulty using the paper ticketing system! As an example, your point of origin and your destination figure into the cost of your fare. Your ticket will only work to enter and exit those two stations. If you make a mistake, you have to talk to the customer service people and use a translator app.

Instead of manually buying a ticket for each trip, I just tap my card when I enter and once again when I leave. The amount of money is automatically calculated and deducted from my account. I find this to be much more convenient than figuring out which stop I will end up at, translating it, entering the information correctly, etc. Also, sometimes you transfer from Rail Company A to Rail Company B on the same trip. When using an IC Card, it’ll automatically figure out that you’re doing a transfer (you have like 5-15 minutes to walk from one station to the next) and apply a discount for you. You don’t have to think about it, you just tap and go.

Pro Tip: Depending on the card, you can personalize it with your name so that if you ever lose it, you can go to any other machine and have it reprinted for a small charge. You will still have all of your balance on that new card.

So what’s the catch? Once you give the company your money, it’s theirs and they can invest it and make interest off it in the bank and so on. That’s essentially it. I think it is far more convenient to use and IC card then cash or credit cards while traveling within Japan.

IC Cards vs Credit Cards

I prefer IC Cards better because there are no transaction fees or conversions. The last time I was in Japan, the exchange rate was ¥109 to $1 USD. As I was there, it would fluctuate up and down a few yen here or there. I would much rather exchange a lot of my currency while the US dollar is stronger and then stick it all on my IC card rather than swipe my credit card every time I want to make a purchase and suffer a small conversion charge or deal with whatever the bank perceives the exchange rate is at that moment in time.

IC Card charges

I’m basing the following info off of my Suica card.

- When you get it at first, there will be a ¥500 deposit. If you turn in your card to a machine later, you will receive a full refund (including the deposit).

- If you request a refund at a booth that has a human, you will probably have to pay a ¥220 charge.

- Please note that these are rates that I personally experienced in 2020.

Coins

On the occasions that I am required to use cash, the coins (for denominations of ¥500 and below) will start to accumulate. I just go and visit the IC card recharge kiosk at the train station when I’m about to board the train and just dump all of the coins into the machine (they won’t take ¥1 and ¥5 coins) and it all gets applied to my account and my pocket gets a little lighter.